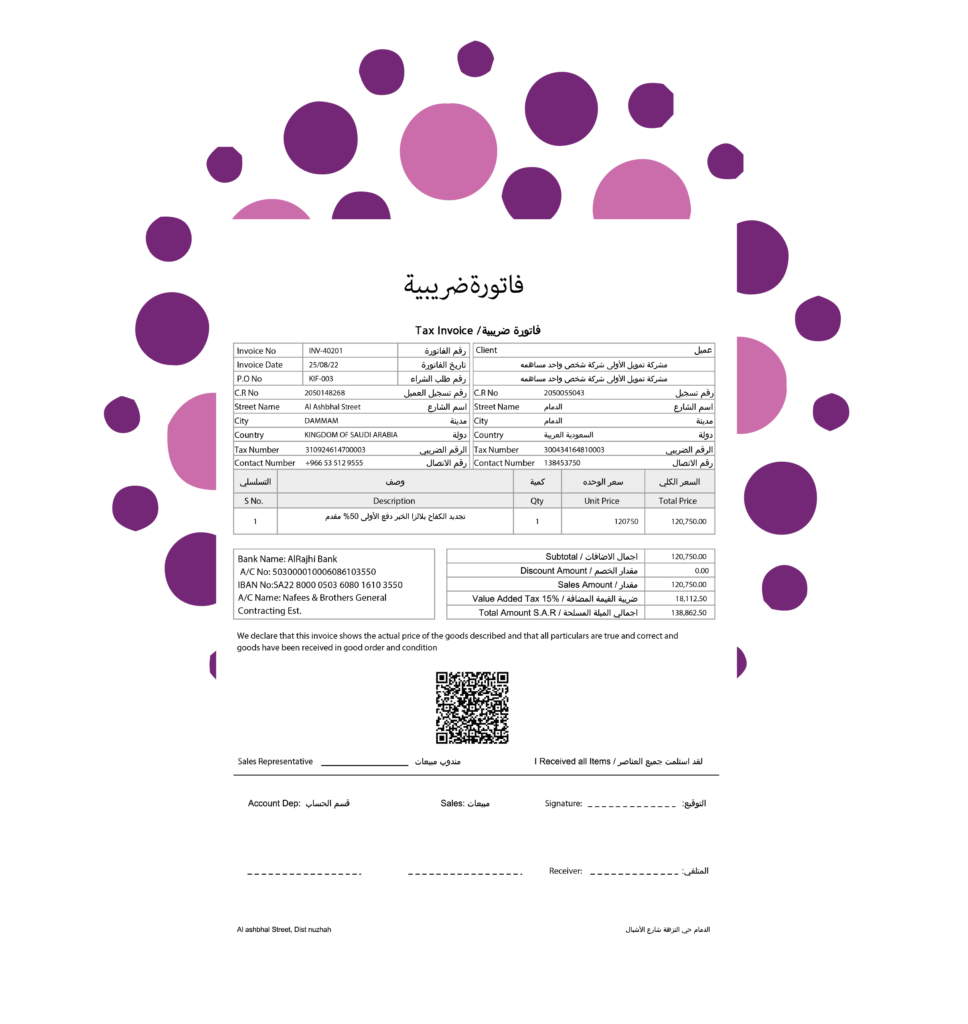

Innovate Integration Phase ll Compliant E Invoice Software

Is Your System Fully Upgraded with ZATCA Phase II Requirements?

- Saudi ZATCA Approved for All Industries

- Software Supports both English & Arabic

- PDF/A3 with XML invoices

- Ready for all Waves of ZATCA Phase 2

- Flexible Solution: Cloud or On-Premises

Innovate Integration Phase ll Compliant E Invoice Software

Is Your System Fully Upgraded with ZATCA Phase II Requirements?

- Saudi ZATCA Approved for All Industries

- Software Supports both English & Arabic

- PDF/A3 with XML invoices

- Ready for all Waves of ZATCA Phase 2

- Flexible Solution: Cloud or On-Premises

Upcoming

Deadline

Wave 9

Integration

Implementation

Deadline

30th Sep, 2024

Target VAT Revenue

in 2021-22

> SAR 30 Million

Experience more than just ZATCA Compliance with our advanced offerings

Form Customization

Process Automation

PDF A3 with xml code

Auto-mail to customer/digital copy download

Invoice activity tracking

Invoice clearing report

Latest

Update

Wave 13

Announced

Implementation

Deadline

31th Mar, 2025

Target VAT Revenue

in 2022-23

> SAR 7 Million

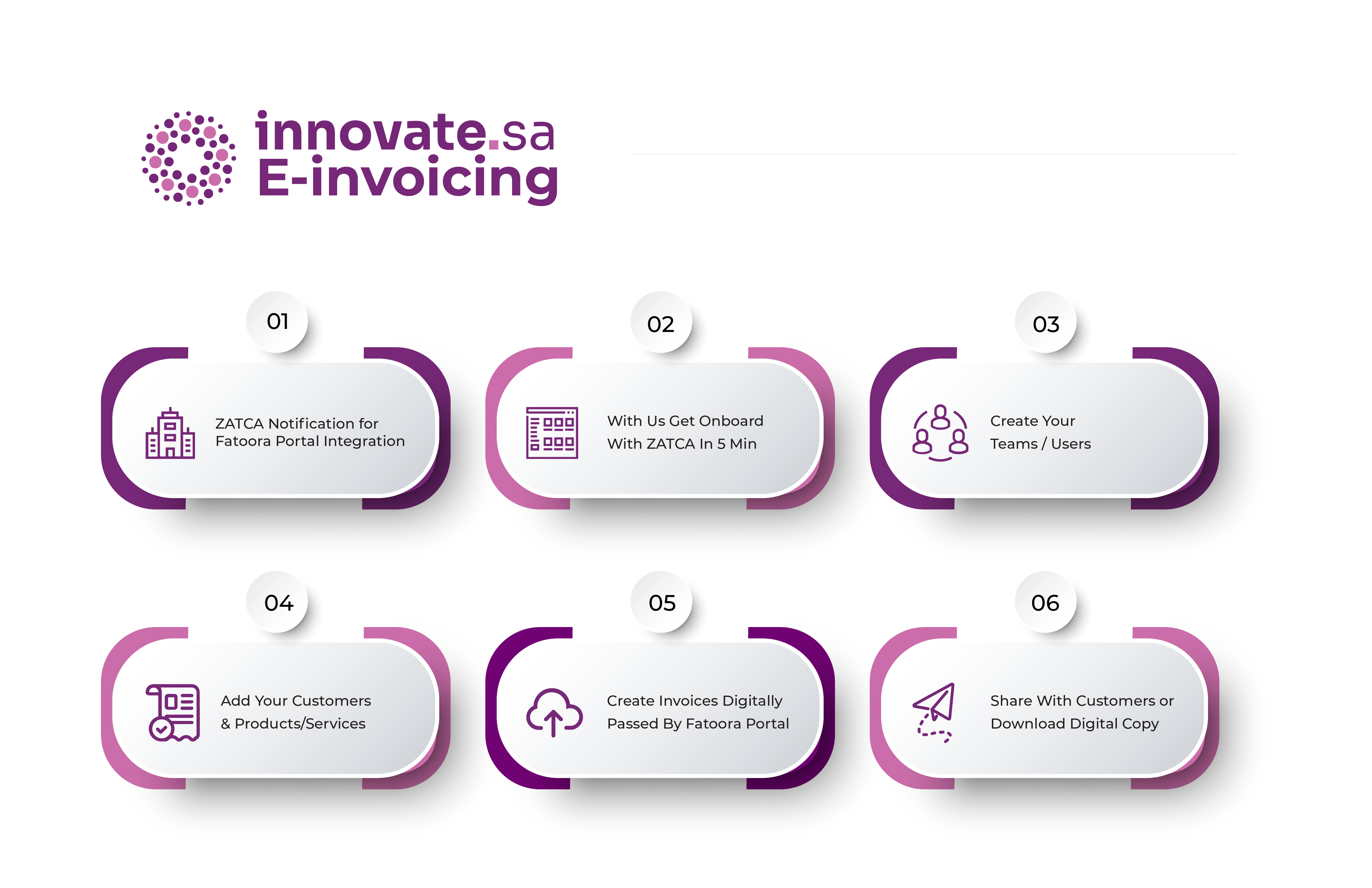

Quickly Onboard & Start Issuing Digitally Compliant Invoices/Notes From Today!

An Exceptional E-Invoicing Tool Making It Easy For Your Business To Manage Invoices Electronically

Easy Configuration

& Reporting

Advance Reporting

Customizable Invoice

Easy

Integration

Generates E - Invoices

Advance Reporting

General

Features

Relevant VAT Details

Handling

Taxes

Digital Storage & Archival

Real-Time Tracking

Phase 2

Compliant

Relevant VAT Details

Handling

Taxes

Digital Storage & Archival

Real-Time Tracking

Phase 2

Compliant

Technical

Features

ZATCA

Integration

QR Code On Tax Invoices

Generate Invoices In XML

Cover All Technical Needs

ZATCA API Integration

ZATCA

Integration

QR Code On Tax Invoices

Generate Invoices In XML

Cover All Technical Needs

ZATCA API Integration

Security

Compliance

Data Processing & Security

Previous Invoice/Note Hash

Uncontrolled Access

OCSP

Responder

Cryptographic Stamp

Secured Connectivity

Data Processing & Security

Previous Invoice/Note Hash

Uncontrolled Access

OCSP

Responder

Cryptographic Stamp

Secured Connectivity

Easy Integration

E-Invoice Integration Is Possible For Any Of Your Existing Systems

ZATCA E-Invoicing Transmission Process Flow

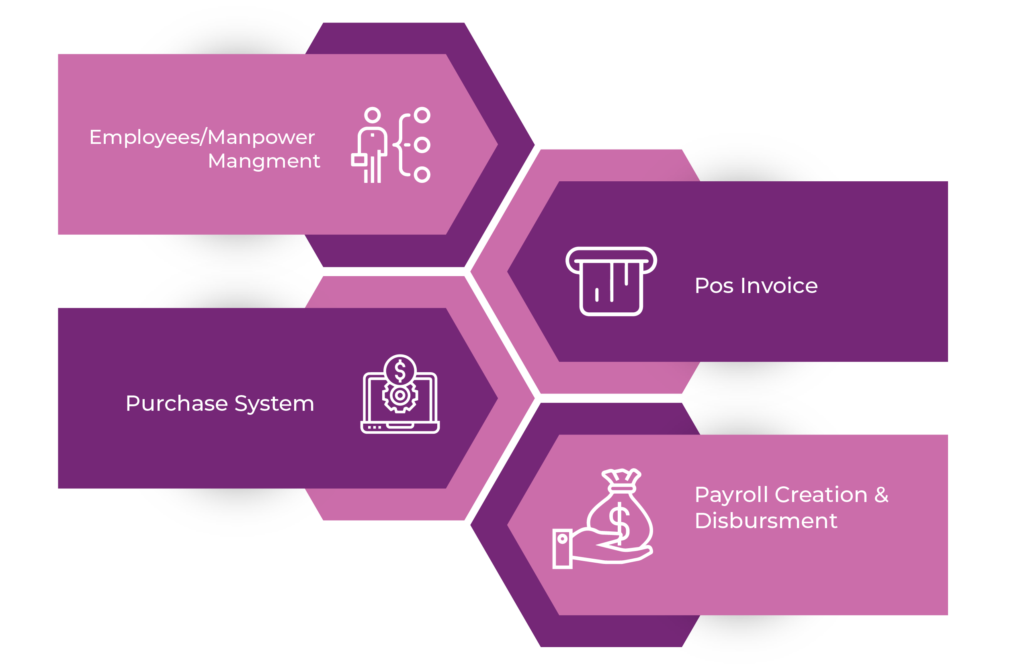

Easily integrate with other modules

- Employees/Manpower Management

- Payroll Creation & Disbursment

- Complete Easy Accounting System

- POS Invoice

- Purchase System

Frequently Asked Questions

Phase 2 also known as integration phase will be applicable from 1st Jan 2023 and will be implemented in waves.

E-invoicing applies to all persons subject to VAT and they will be notified 6 months in advance before the implementation of waves.

All the businesses subject to VAT, exceeding 3 billion are to be complied with the first wave of e-invoicing requirements.

QR codes are necessary as it streamlines tax invoices which are standardized through e-invoices.

Invoices are formatted in the range A-3 with embedded XML or PDF. However, to allow clearance, the intended invoice should be in XML format.

The Universally Unique Identifier carries the unique number that enables tracking of invoices throughout its life cycle.

For e-invoicing, the provider’s software should be connected to the ZATCA’ system (Fatoora Portal). This requires an internet connection.

Have A Query Related To ZATCA E-Invoicing?

Get Your Queries Answered From Our One Of The Best Legal Consultants